The Best Guide To Nj Cash Buyers

Table of ContentsNot known Details About Nj Cash Buyers Nj Cash Buyers - The FactsThe smart Trick of Nj Cash Buyers That Nobody is Talking AboutThe 5-Second Trick For Nj Cash Buyers

The majority of states grant consumers a particular degree of protection from creditors regarding their home. "That implies, regardless of the value of the house, lenders can not force its sale to satisfy their cases," states Semrad.If your home, as an example, deserves $500,000 and the home's home mortgage is $400,000, your homestead exception can protect against the forced sale of your home in order to pay financial institutions the $100,000 of equity in your house, as long as your state's homestead exception is at least $100,000. If your state's exemption is less than $100,000, a personal bankruptcy trustee could still require the sale of your home to pay creditors with the home's equity in unwanted of the exemption. If you fail to pay your home, state, or government taxes, you might lose your home via a tax lien. Buying a house is much easier with money.

(https://www.callupcontact.com/b/businessprofile/NJ_CASH_BUYERS/9357806)Aug. 7, 2023 In today's warm market, especially in the Hand Beach Gardens and Jupiter real estate location, cash deals can be king but, there are reasons that you could not intend to pay cash money. I understand that numerous sellers are more probable to accept a deal of cash, yet the seller will certainly get the cash no matter whether it is funded or all-cash.

The Greatest Guide To Nj Cash Buyers

Today, about 30% of United States homebuyers pay cash for their residential properties. There might be some great factors not to pay cash money.

You may have credentials for an outstanding home mortgage. According to a current study by Cash publication, Generation X and millennials are considered to be populations with the most prospective for development as consumers. Taking on a little bit of debt, particularly for tax functions terrific terms could be a much better alternative for your funds overall.

Possibly purchasing the supply market, common funds or a personal service could be a much better option for you over time. By purchasing a home with money, you take the chance of diminishing your book funds, leaving you at risk to unanticipated upkeep expenditures. Possessing a property entails ongoing expenses, and without a home mortgage pillow, unforeseen repair services or restorations can stress your funds and impede your capacity to keep the property's problem.

Nj Cash Buyers Fundamentals Explained

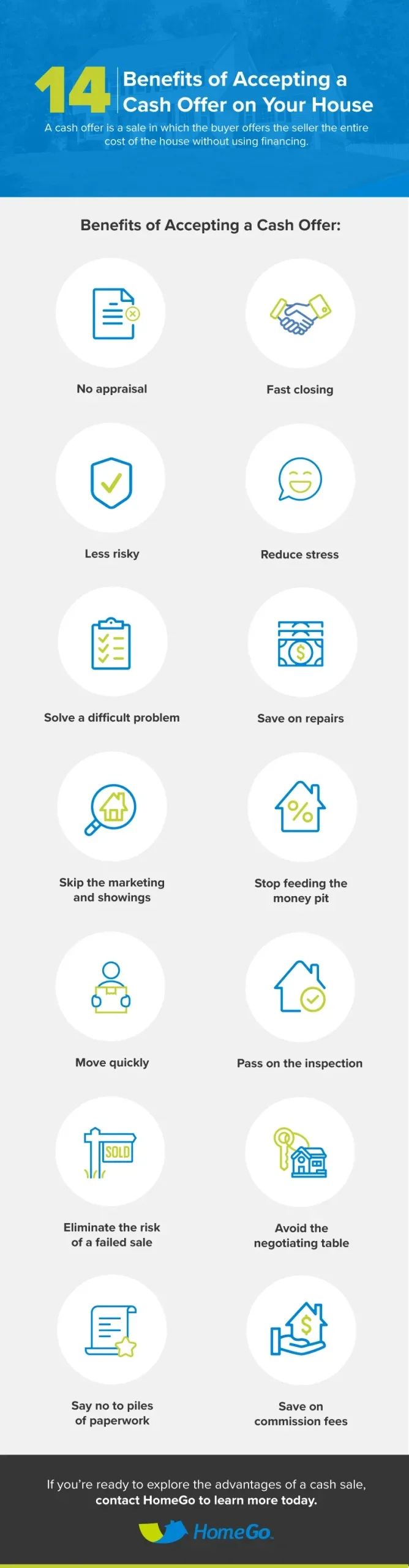

Home rates fluctuate with the economic situation so unless you're intending on hanging onto the residence for 10 to thirty years, you could be better off spending that cash money somewhere else. Buying a building with cash can accelerate the buying process dramatically. Without the need for a home mortgage approval and associated documents, the purchase can close much faster, offering an affordable side in competitive realty markets where vendors may choose money buyers.

This can lead to significant cost savings over the long-term, as you will not be paying passion on the lending amount. Money customers typically have stronger negotiation power when handling vendors. A cash offer is more attractive to sellers considering that it lowers the risk of a deal failing as a result of mortgage-related concerns.

Bear in mind, there is no one-size-fits-all solution; it's vital to tailor your choice based upon your individual situations and long-lasting goals. Prepared to start taking a look at homes? Provide me a phone call anytime.

Whether you're liquidating possessions for an investment home or are carefully saving to purchase your desire residence, acquiring a home in all cash money can dramatically raise your acquiring power. It's a critical step that enhances your setting as a purchaser and improves your adaptability in the realty market. It can place you in an economically susceptible spot.

The 8-Minute Rule for Nj Cash Buyers

Saving money on interest is among one of the most typical factors to purchase a home in money. Throughout a 30-year mortgage, you can pay tens of thousands or also hundreds of hundreds of dollars in complete interest. Furthermore, your buying power raises without financing backups, you can check out a wider option of homes.

Genuine estate is one financial investment that often tends to exceed inflation with time. Unlike stocks and bonds, it's thought about much less high-risk and can provide short- and long-lasting riches gain. One caution to note is that throughout specific economic markets, genuine estate can create much less ROI than various other financial investment enters the brief term.

The largest risk of paying cash for a home is that it can make your funds unpredictable. Locking up your fluid properties in a residential property can lower economic flexibility and make it more challenging to cover unexpected costs. Additionally, binding your cash money indicates losing out on high-earning financial investment possibilities that can produce higher returns in other places.